If you really want to get a sense of just how much the Trump tariff brain decimation has upended thing, just look at the market expectation for interest rates.

Back in February when the RBA cut the cash rate to 4.1% the market got the sense from the RBA Governor Michel Bullock that she rather liked high interest rates and thought we all needed to be still very worried about inflation even though inflation was below 3%.

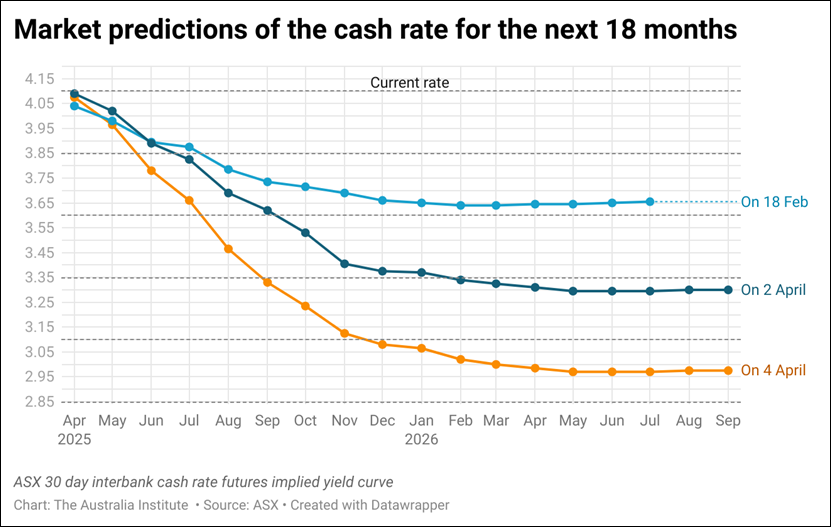

The market anticipated maybe TWO rate cuts in the next 18 months. This was the time in which both major political parties were getting ready to go to the election. And you can bet the LNP was planning to hammer the issue of high interest rates all the live long day.

After the RBA’s meeting last week, the market was now of the view that all the inflation figures were very much looking good and that even while the RBA might have been far too scared to cut rates lest it look “political” a cut in May was almost certain and THREE rate cuts in the next 18 months was on the cards.

That rather dimmed the LNP’s attack because while the RBA had not cut rates, no one was out there saying they would not be cutting rates. It was clear worries about high interest rates was dimming.

Then Trump released his noxious fumes around the world.

Just three days after the RBA meeting the market had shifted to now expecting FOUR rate cuts by the end of this year.

Why? Well, all those fears of inflation are gone, and the need for the RBA to cut rates to help stimulate the economy are now all anyone was thinking about.

And with it as well has the entirety of the economy frame of this campaign.

No comments yet

Be the first to comment on this post.