Wealth inequality in Australia has dramatically worsened over the past 20 years, mainly being driven by investment properties (excluding the family home).

That’s right the housing crisis is also driving an inequality crisis.

The richest 10% have seen their property assets grow by an average of $2.2 million per household over the last two decades.

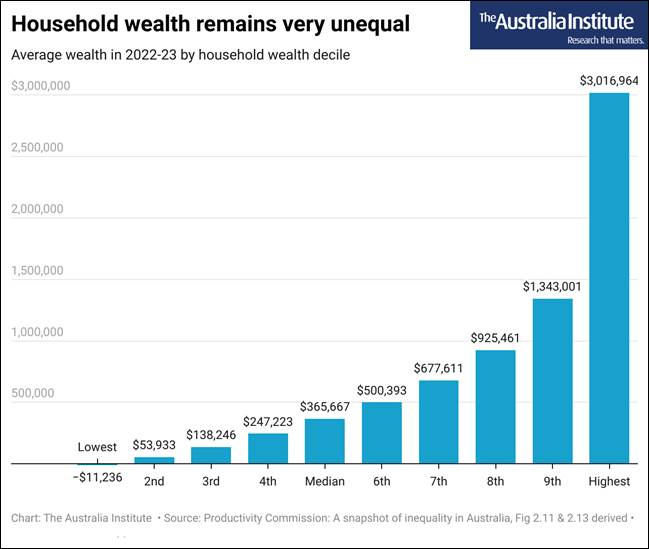

According to the Productivity Commission the wealthiest 10% have around 725% more wealth than do median households – that’s a difference of around $2.65m on average

Making the inequality worse is that wealth is taxed at much lower rates than income. $100 billion of tax concessions goes to the three biggest assets: other property, superannuation, and the family home.

Investment properties are highly concentrated with half of their increase over the last 20 years going to the richest 10%. This was worth $900,000 per household.

The poorest half of Australian households got just 7% of the benefit ($24,000 over 20 years).

Cracking down on negative gearing and the capital gains tax discount will not only make housing more affordable, it will also reduce one of the biggest drivers of wealth inequality. That’s win-win.

1 Comment

I guess you would have encountered Gary's Economics. Wealth tax discussions in the UK are getting more realistic with his expertise but the push back from corporate media reveals, yet again, who is (invisibly) behind the economic policy settings