Nationals MP, Jamie Chaffey asked the PM if he would rule out getting rid of the fuel tax credits. Chaffey made it sound like this great necessity for farmers, but in reality it’s a rort for miners.

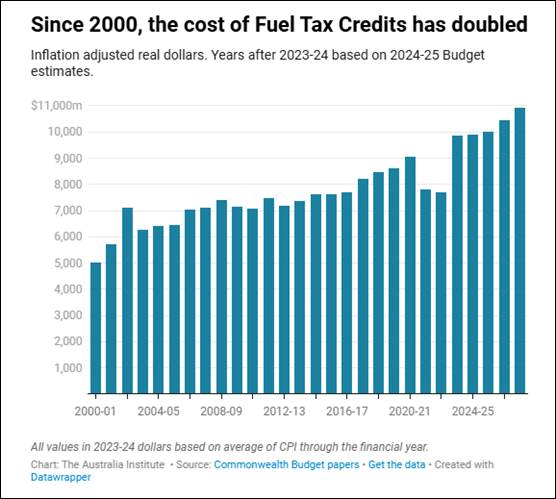

Our research has shown that the cost of the fuel tax credit, which notionally rebates the cost of fuel for those who don’t use roads, is growing each year and is now hitting $11bn

The OECD has called for the scheme to end because it just subsidies fossil fuels

The FTCS is the largest fossil fuel subsidy in Australia. In 2024-25 it is expected to cost the Australian Government $10.9 billion. Even worse the Budget Papers note that the expected increase in the fuel tax credit over the next 4 years “largely reflects an expected increase in the use of fuels that are eligible for the Fuel Tax Credit Scheme”.

In total, Australian state and federal governments provided $14.5 billion worth of subsidies to fossil fuel industries in 2023-24, a 31% increase on 2022-23.

The overwhelming beneficiary of the FTCS is Australia’s mining industry. The coal mining industry received refunds of over $1 billion through the FTCS in 2020-21. This means the FTCS not only subsidises consumption of fossil fuels but also provides subsidies to fossil-fuel producers.

Fossil-fuel subsidies undermine efforts to prevent the worst impacts of climate change.

Abolishing the FTCS would free up that money to be spent on domestic or international efforts to mitigate or adapt to climate change with no impact on the budget bottom line.

No comments yet

Be the first to comment on this post.