In the run up to Jim Chalmer’s Productivity-Tax Roundtable next month there’s been a lot of talk about what should be in/out etc.

We will be putting in our submission on Friday, but today I wrote in my Guardian column on a report ACOSS will put out today titled “Taxing income less and consumption more: The case against”

The report nicely slaps around some of the dumb myths that get pt out about tax. I wrote is up in the form of 3 things that need to be agreed to before you should be able to participate in any discussion on tax:

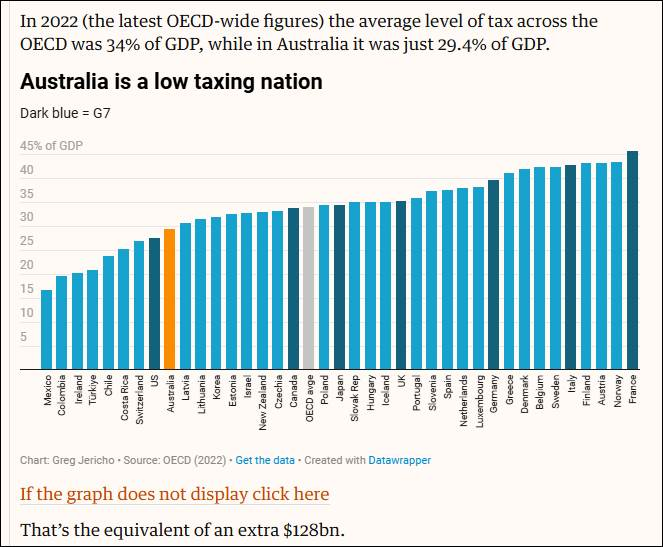

- Australia is a low-taxing nation

We hear at the Aus Institute like to preach this line, but as the ACOSS report shows it’s not because we are making stuff up – it IS THE REALITY

Right now we raise less tax than every nation in the G7 except for the US, and they are only just below us

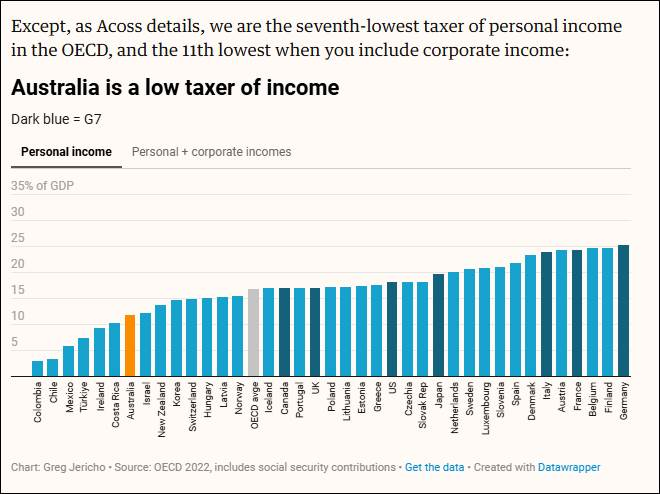

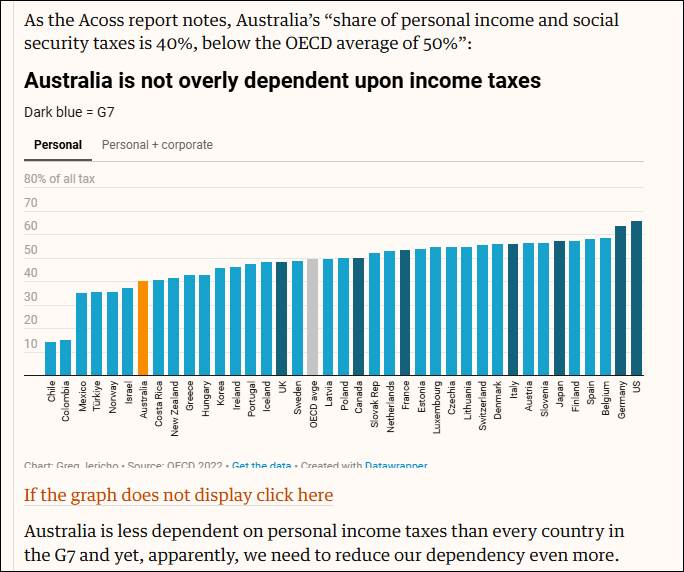

- We are not overly dependent on income tax.

Cripes I get this a lot in interview. It is taken as given they we tax income too much and worse we do it a lot more than other nations.

Sorry, as ACOSS notes, that utter bull

Not only do we tax income much less than most other advanced economises we are all LESS RELIANT ON IT:

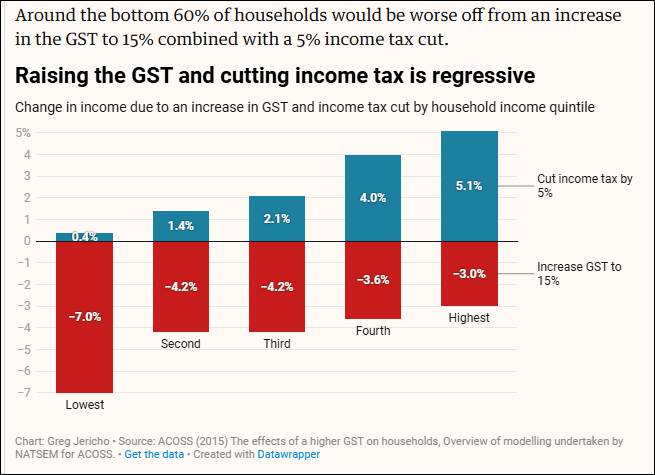

- Increasing the GST will hurt low-middle income earners

Look, this should be pretty obvious, but it is amazing how many economists love the GST because they think it is oh so gloriously efficient.

Well as the ACOSS report show it really isn’t all that much more efficient than income tax, but it is much more regressive.

ACOSS used some Treasury modelling that found if you raised the GST to 15% and cut income tax by 5% the bottom 60% of households would be worse off, and the top 20% would be significantly better off.

So if we are talking GST we need to talk about broadening it – eg including it on private health insurance or private school fees. If all we are doing is raising it, then we are just dumping on poor people for now good reason at all.

The full article is here – have a read there’s a lot more graphs to play with!

No comments yet

Be the first to comment on this post.