There is absolutely no expectation that the RBA will announce a rate cut today at 2:30pm.

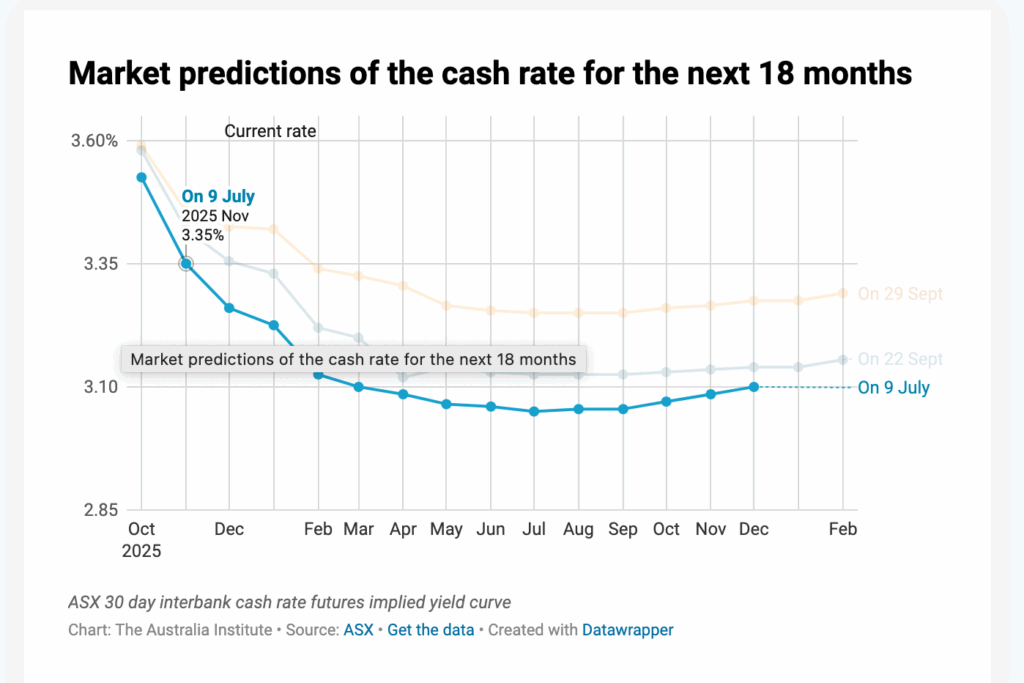

Back in July investors were betting that there would be a rate cut by November and two by March next year. Now the RBA is not expected to cut rates at all until March:

At 2:30pm we will get the reasons from the RBA monetary policy board.

In August, when it did cut rate, the board said “The Board nevertheless remains cautious about the outlook, particularly given the heightened level of uncertainty about both aggregate demand and potential supply” and I suspect uncertainty will again be the order of the day in its statement.

It is worth remembering that while it did cut rates in August, it didn’t in July, when everyone expected they would. Back then the board said “Nevertheless it remains cautious about the outlook, particularly given the heightened level of uncertainty about both aggregate demand and supply.”

So yeah, sometimes uncertainty means we need a cut, sometimes it is the excuse not to cut.

It is worth noting that the most recent GDP figures showed the economy in the first 6 months of this year grew only at an annualised rate of 1.7% – a fair way below the long-term average of between 2.75% and 3% that is needed to stop unemployment from rising.

This year, unemployment has been rising this year, and seems headed to 4.5%, which is pretty sad given in December there was very much the hope of locking in 4% as the ceiling.

But the RBA thinks we need more people out of a job so we all won’t feel confident about bargaining for better wage rises and instead will be content that we have a job.

No comments yet

Be the first to comment on this post.