Tim Wilson is back and asking his first question and it is 2019 all over again.

Wilson asks about the super tax concessions as well – “my question is to the Treasurer. On 28 February 2023, the Treasurer said, ‘Labor’s unfair super tax on unrealised capital gapes would apply to’ Around 80,000 people.” Does the Treasurer stand by that number?”

Probably a good time to remind our gentle readers that Wilson ran the anti-franking credits change campaign in the 2019 election, even chairing an inquiry into it. At the time Wilson was also an investor and shareholder in Wilson Asset Management, which was founded (and from memory, chaired) by Geoff Wilson, a relative of his.

Jim Chalmers answers:

First of all, Mr Speaker, I didn’t describe it the way that the honourable member has said. That’s the first point. Second point is that when we announced the policy the expectation was that there would be about 0.5% of people in the superannuation system impacted by what is a very modest change in terms of the impact on individuals but it would make a meaningful contribution to making the superannuation system more sustainable, that remains our view.

About 0.5% of people and that obviously varies from fund to fund. If you think about the fund that was in the paper today, their expectations at host plus is that 57 members out of 1.86 million members would be impacted by the modest changes that we are proposing.

As the Assistant Treasurer said a moment ago, we are the big believers in superannuation. We’re about strengthening superannuation and those opposite are about weakening superannuation. For evidence of that, Mr Speaker, think about the fact that on 1 July this year we completed the journey to 12 per cent compulsory superannuation.

That’s something we’re very proud of on this side of the House. So, too, are we proud to be paying the superannuation guarantee on government paid parental leave for the first time ever, Mr Speaker. I shout out the Minister here for the work that we did on that in the last term of Parliament.

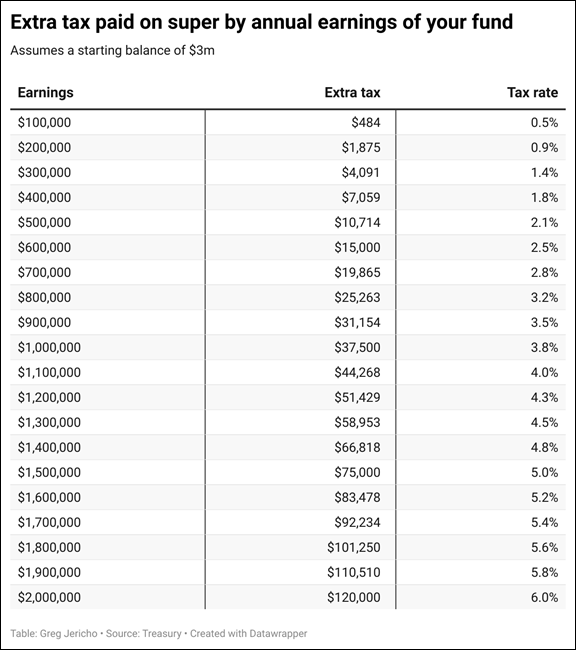

Part of our responsibility to the superannuation system is to make sure that it is treated in a concessional way, that those concessions are generous but also and that they are sustainable. After these changes are implemented, there still will be generous tax concessions for everyone in the superannuation system but for the 0.5% of people with balances more than $3 million, remembering the average retirement ball about is about $340,000…

(Wilson has a point of order that is not a point of order)

Chalmers:

It remains our expectation about 0.5% of people in the superannuation system will be impacted by this modest change.

They’ll still get very generous tax concessions in superannuation, it will be slightly less generous. For example, someone with $3 million instead of getting a $14,000 tax break they’ll get a $13,000 tax break for their investment. So it continues to be concessional. I think the respected financial commentator Noel Whittaker has made a similar point, it remains concessional for everyone but a bit less so for people with more than $3 million.

I think what this question shows apart from the fact that that Shadow Treasurer has already been benched is this side of the House cutting taxes for 14 million Australians that, side of the House going to the House for 0.5% of people in the superannuation system who already have more than $3 million in super.