The inflation dragon is slain – but the economy needs help

With all the attention on the quarterly inflation rate, people may be overlooking that the inflation figures for the month of June also came out today. The monthly inflation figures are less accurate than the quarterly figures but they do give us a look at where inflation is heading.

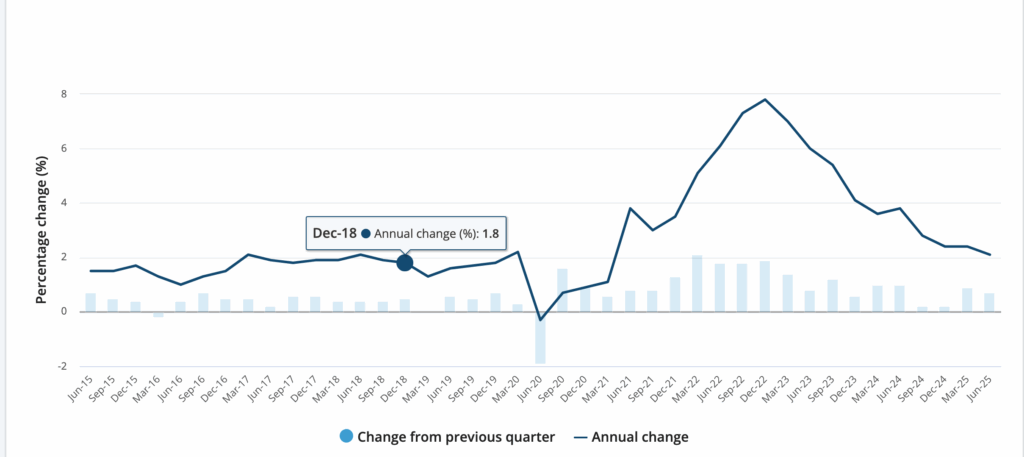

The latest monthly figures show inflation for the year was just 1.9%. Yep, you read that right. This means that inflation has fallen outside the RBA band.

You might think this is good. After all, isn’t low inflation a good thing?

The problem is that when inflation get too low, it comes with a stagnating economy, and higher unemployment. You know… like what is happening in the Australian economy right now.

The most recent economic growth figures were just 0.2% for the March quarter. Unemployment jumped up to 4.3% for June. The highest since the economy was gripped by the pandemic.

These monthly figures highlight again that the risk is a stagnating economy. The inflation dragon is dead.