Ok, so the morning has been pretty low energy. That is becoming a bit of a pattern.

Let us see what QT bowls up (nothing good, I can guarantee that)

Mon 25 Aug

This blog is now closed.

Ok, so the morning has been pretty low energy. That is becoming a bit of a pattern.

Let us see what QT bowls up (nothing good, I can guarantee that)

This weekend, hundreds of thousands of Australians filled the streets of cities and towns across the nation to protests again the war in Gaza. But anti-protest laws passed in the past few years could curb similar outpourings of public support.

A 2024 report by the Human Rights Law Centre found there had been 49 laws passed over the last two decades eroding Australians’ right to protest.

To give one example, in 2023 the South Australian Government introduced laws that mean people can be fined up to $50,000, or sentenced to three months jail for “intentionally or recklessly obstructing the free passage of a public place.”

Just this weekend, people in Brisbane were forced to take an alternative route after a court put an end to their plans to walk across the Story Bridge.

But from women’s suffrage to better working conditions, protest is how Australians have won change, and research polling from The Australia Institute shows that more than two thirds (71%) of Australians say that the right to protest should be protected by federal legislation.

Recent anti-protest laws are primarily aimed at climate action protestors, but if protests against the war in Gaza continue to grow, their limits could be tested in unexpected ways.

Holy Moly it is almost question time.

Time really does fly when you are in the depths of an on-going existential crisis, huh?

Go grab what you need – we will have you covered for the main event

Over in the senate and Labor and the Coalition have voted for the legislation that allows the Australian government to expand its defence housing scheme to build homes for US soldiers working on the Aukus contracts.

Greens senator David Shoebridge says it is ridiculous:

The Greens have for years been campaigning for more public housing. The Albanese Government has attacked these calls, labelling public housing as unrealistic. Turns out it wasn’t.

Today we learned if you want to live in public housing built by Labor you’d better join the US military and get Donald Trump on your side.

AUKUS is draining public funding into the pockets of the US military and foreign arms companies.

This Bill will not just allow for the Albanese Government to build houses for US troops but also for foreign arms companies and contractors. That means public housing for contractors from Lockheed Martin, Boeing, Northrop Grumman, Elbit Systems, Rafael and others.

It is a sick joke that Labor will be taking money from critical social programs, including funding to build houses for Australians in desperate need, and instead spend it on housing US troops in Fremantle.

The first major housing bill that this government passes will be about paying tribute to Donald Trump and the US military. That’s a disturbing message about the priorities of this government.”

The Australian Workers’ Union wants an immediate gas reservation and more intervention in the gas market from the federal government.

This is a pretty big deal. For a long time, there was the belief that the gas companies needed to be babied to ensure that manufacturing would receive its due. But that is obviously not the case and the unions are now making sure their voice (and case) are heard.

The AWU has submitted a proposal to the gas market review the federal government has set up “demanding an immediate east coast gas reservation scheme that would apply to all three Queensland LNG exporters from day one”

And that includes EXISTING has fields.

AWU National Secretary Paul Farrow said the time for half-measures was over:

Because of a series of weak and stupid decisions by Australian governments during the

late 2000s and early 2010s foreign gas giants operating here have been gifted the sweetest

deal out of anywhere in the world,” Mr Farrow said.“They’ve been able to pump our gas out of the ground and simply flog it to the highest

foreign bidder without restriction. These multinationals should be kissing the boots of

every Australian taxpayer for the run they’ve had over the last ten years. But it’s time for a

fairer deal.”

“The idea [gas companies] will pack up and leave if we tighten the rules is a bluff. Why would they walk away from billions in profits? Of course they’ll cry wolf – I’d cry wolf too if I was dealing with

a patsy like Australia who has fallen for it every time,” he said.“The government’s job is to stand firm and make sure Australians get a fair return, not cave

to empty threats. I represent workers in the gas extraction industry and I unashamedly

support the industry’s future in Australia. These workers are my members. I don’t want

them to lose their jobs, and I know they won’t.”

Among the AWU’s submission is:

It’s a shame Friday’s energy statistics weren’t available for last week’s Economic Roundtable.

The roundtable agreed that EVs users should be charged because of the claim that because EVs don’t pay fuel tax, somehow Australia won’t be able to pay for roads.

Then came the stats on car registrations:

This shows that EVs are still less than 5% of vehicles, petrol vehicles are still increasing and diesel vehicles are booming.

If the Government is serious about raising more fuel tax revenue, they could always make the mining industry pay some. The mining industry pays nothing in fuel tax, despite being one of the biggest diesel using sectors.

At least the stock market is ok!

As AAP reports:

Australia’s share market has pierced yet another record after a pivot from the world’s largest central bank reinvigorated risk-on investor sentiment.

The S&P/ASX200 spiked to a new intraday peak of 9,054.5, but by midday was up just 11.5 points, or 0.13 per cent, to 8,978.9, while the broader All Ordinaries gained 17.5 points, or 0.19 per cent, to 9,251.8.

The wave of buying followed a Wall Street rally on Friday after US Federal Reserve chair Jerome Powell hinted at incoming interest rate cuts for the world’s largest economy.

“While emphasising the balance of risks between heating inflation and cooling employment, his observation that interest rates remain above neutral was enough to set investors buying stocks,” Moomoo market strategist Michael McCarthy said.

Despite the fresh record, only five of 11 local sectors were trading higher by Monday lunchtime, with raw materials stocks (+2.6 per cent) and the energy sector (+1.4 per cent) lifting the bourse.

Large-cap miners BHP, Fortescue and Rio Tinto each surged two per cent or more, tracking with a lift in iron ore prices.

On the energy front, Woodside and Santos were up more than 1.2 per cent each, despite oil and gas prices contributing to a 22 per cent drop in first-half profits for Santos.

Financials weighed on the bourse, slipping 0.9 per cent after opening the day at a new high, with all big four banks sliding into the red shortly after the opening bell.

Westpac was the worst performer, slipping 1.6 per cent to $38.36, while CBA fell 1.3 per cent to $170.56 a share.

Bendigo and Adelaide Bank gained 2.4 per cent to $13.31, despite posting a full-year net loss of $97.1 million, due mainly to a goodwill impairment announced the week before.

Retail stocks are having a rough day with consumer staples down one per cent and consumer discretionary stocks losing 0.9 per cent, tracking with downticks in Coles, Woolworths, Wesfarmers and JB Hi-Fi.

Dan Murphy’s and BWS owner Endeavour Group was also down after its full-year profits slipped more than 16 per cent amid supply chain issues and weaker alcohol sales.

Real estate stocks were performing well, up 0.4 per cent, tracking with a similar gain for sector giant Goodman Group.

Also riding on the back of a sector behemoth were healthcare stocks, up 0.8 per cent as CSL clawed back some of its post-earnings price plunge from the week before.

The Australian dollar shot ahead after the Fed’s comments sent yields higher and weighed on the greenback. The Aussie is buying 64.73 US cents, up from 64.19 US cents on Friday afternoon.

The Barnaby net-zero thing is a sick joke, and so are government claims that they’ve got climate action under control.

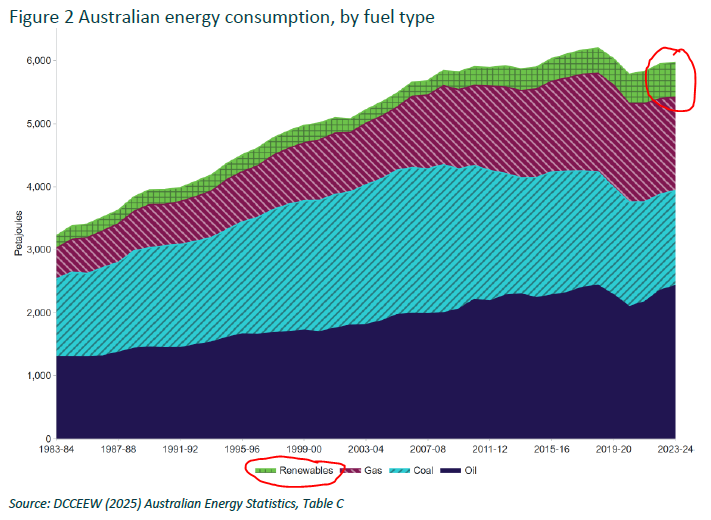

Last Friday’s new stats show that renewables made up less than 10% of Australia’s energy consumption in 2023-24:

There is still a VERY long way to go to phase out gas, oil and coal. This can only be done by electrifying things and expanding renewables. No amount of dodgy carbon offsets will fix this.

Grattan Institute head Dr Aruna Sathanapally made the common-sensical but important observation that “Australians will have to expect a lower service delivery from the government if taxes don’t go up” (as reported by ABC News).

Prime Minister Anthony Albanese brushed off her concerns saying:

“Academics talk in academic words. What I do is live in the real world, and in the real world, my government’s focused on delivering for people.”

It’s a strange deflection. You don’t have to have worked for NSW Treasury, though Dr Sathanapally has, to realise that taxes are necessary for government services.

In fact, Australia Institute polling research back in 2021 showed that Australians understand perfectly how taxes work “in the real world”:

When asked what they wanted the government to prioritise in the next budget, Australians preferred spending on government services like health, education, infrastructure and income support for people looking for work over tax cuts.

This is not about academics. This is about how Australians access important services, including healthcare, education and infrastructure.

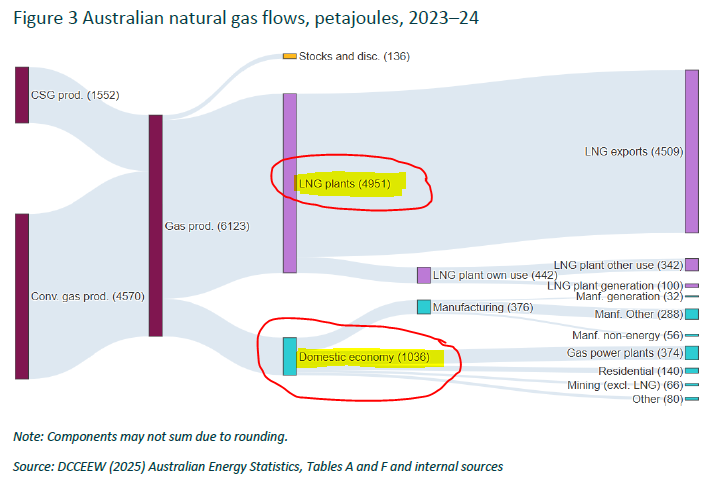

New data dropped last Friday – the 2025 Australian Energy Statistics came out.

This publication always has an interesting diagram on Australian gas production and use. Here it is, showing that exports (LNG plants) are FIVE TIMES bigger than the entire “domestic economy” usage:

This shows that gas exporters sold 4,951 petajoules (PJ), while the entire domestic economy used 1,036 PJ.

For context, your home bbq gas bottle contains around 417 megajoules, so gas exports were about 12 million bbq gas bottles, one for every person in Melbourne, Sydney and Adelaide.

Also interesting in that diagram is “LNG plant own use (442)” and “Manufacturing (376)”. This shows that gas exporters use 20% more gas to run the freezers to liquify and export gas than Australia’s entire manufacturing sector uses.

Australia doesn’t have a gas shortage, we have a gas export problem.