Q: Alright, I want to go to the markets now, as in the stock markets, they tell you something about the future. They tell you that the risk of a recession is much higher. Peter Dutton has said, basically, under a under a Labor government, if re elected, Australia will go into recession. Why wouldn’t Australia go into recession if there’s a coalition government in power, surely you’ve got to have if it’s good for one, it’s good for the other. You can’t avoid that.

Taylor:

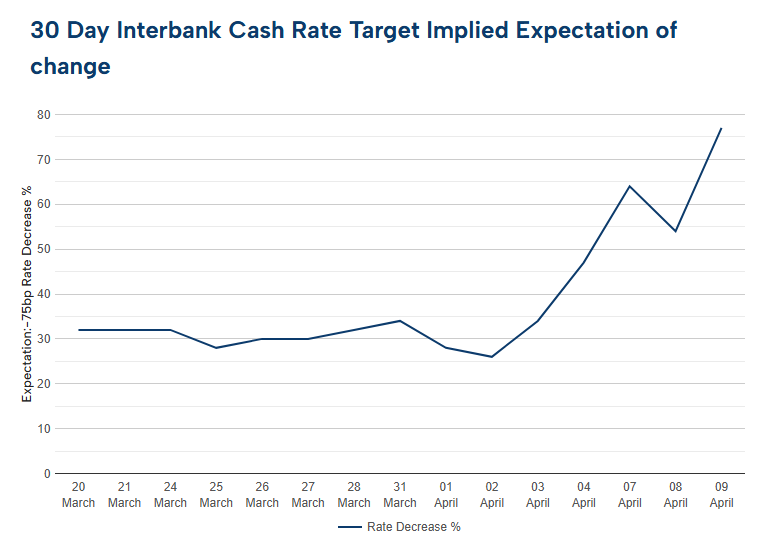

Well, Peter is responding to Jim’s forecast, which is now forecasting interest rates cuts.

He likes to forecast, we need someone who wants to manage the economy, not just forecast, and he was forecasting big cuts in interest rates. Now that’s only going to happen if the economy is falling off a cliff. If there’s something that Jim knows about the economy falling off a cliff, he should be telling us

Interest rates under the Morrison government were as low as they possibly could be in Australia, so what does that tell you about how Taylor would judge the Morrison government’s economic management?