Sukkar and O’Neil are arguing about social and public housing.

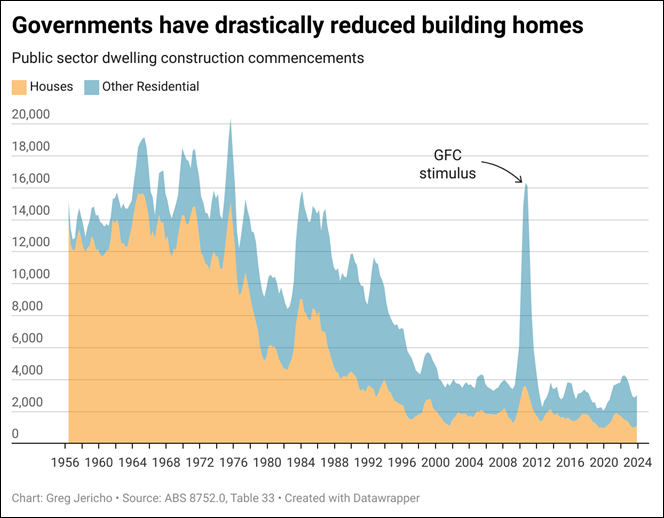

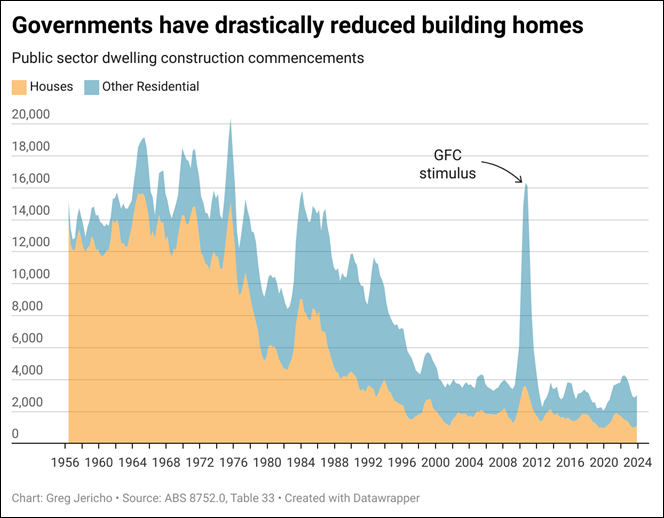

This is one area where no governments of the past 25 years should be boasting. Apart from the GFC stimulus public housing is in despair

Wed 16 Apr

This debate is now closed.

Sukkar and O’Neil are arguing about social and public housing.

This is one area where no governments of the past 25 years should be boasting. Apart from the GFC stimulus public housing is in despair

Clare O’Neil:

You mentioned social and affordable housing. Thank God that is getting air time today because this is one of missing pieces of the debate. We have a chronic national shortage of social and affordable housing around the country. We have a growing homelessness problem around the country, which is directly related to this. We have people in severe housing distress. Well, our Government is stepping up and doing something about it.

We’re building 55,000 social and affordable housing homes. 28,000 of those homes are in construction or development right now.

Now, Michael may denigrate targets. In fact, the Liberals did almost nothing about social and affordable housing when they were in government. Well, you scoff but let me give you numbers. You’re criticising our government for what you say is not building enough homes. Do you know how many homes the Coalition built, social and affordable housing, over their almost a decade. More than you. 373. That is what they added to social and affordable housing stock. 373.

Sukkar:

Wrong. Wrong.

O’Neil:

As a minister, as a minister, as a politician, that doesn’t make me happy. Because it makes a political point. It makes me angry. There are people around our country who need the Government’s house to have stable housing and the Liberals built 373 of those homes over a decade. Now, we’ve got 28,000 homes in development right now.

That is a serious number of homes on the pathway to 55,000 around the country. And I just say to Michael – we’ve got to change the way that the Government engages with housing in this country. We’re not going to get anywhere in this debate if we put together a bunch of silly policies, written on the back of a napkin, that are going to build fewer homes for the country that will be more expensive for people that can’t get into them.

I can absolutely guarantee you, if the Coalition are elected, this concoction is going to make the housing crisis worse. We need to change the Government’s approach and that is what our Government is doing.

We are going to fact check that number for you .

The Liberal Party love the idea of first-home buyer accessing up to $50,000 of their superannuation to use for a deposit. But how much do people in the 30s, who the policy is aimed at have in their super?

Well the median in 2021-22 was between $34,000 and $39,000 for their early 30s and $54,000 to $70,000 for those in their late 30s.

In essence for most people using $50,000 of you super would destroy your superannuation base.

It’s a great policy for those who have stonks in their super. But those people are also those more likely to already have the money or wealth to have saved for a deposit.

So this, much like the policy to deduct interest repayments, is something that will benefit those who already can afford to buy a home, and do so in a way that increases the ability to bid higher for homes – which will cause house prices to rise.

A certain phrase seems rather lacking from the debate

Sukkar is asked the same question, given Peter Dutton said the same thing this week and says:

Look, I think Clare has copped some unfair criticism, because I think it is… It would be quite devastating for a young first home-buyer who has owned a home for one or two or three years to suddenly go into negative equity, which is the consequence of what some of the suggestions have been.

What I said very clearly is – you absolutely want wages growing more quickly than house prices. There’s no doubt about it.

But you can have a situation where you have modest house price growth, but you still have wages growth that outpaces it. And what we need to see is a period where wages growth sustainably outpaces housing growth. That’s house price growth.

That’s the only way that you’re going to end up in a situation where it’s more affordable to own a home. Let’s not forget the GFC in 2008 where we saw in the United States significant drops in house prices, and the devastating consequences that it had on that economy. To be wishing that on our economy, I think, would in the end, hurt young Australians more than anybody

Q: You spoke about distress, anger, rage, facing young people. But last year, when you went on youth radio station triple j, you said “We’re not trying to bring down house prices. That may be the view of young people but not the view of our government.”

Instead, you insisted that you wanted sustainable growth. Do you accept that ever increasing house prices is part of what is causing young people distress in trying to get into homeownership and define sustainable growth?

Clare O’Neil:

A very important question. I really appreciate you asking it. Firstly, I would just say, I genuinely and deeply understand and feel the pressure that young people are under. And I understand why, particularly young people, but not just young people, are looking at this problem and thinking that declining house prices is the answer. What I would just say is that we’ve also got a generation of pretty young people who have come into the market in the last ten years. Many of them have taken on incredibly large mortgages while interest rates were low. And we don’t want, nor is it good for the country, to see that generation go into negative equity.

So we do need to have is a balanced approach here. What we need to do is make sure that we build more housing in our country. And I don’t think that we’ve repeated it enough in this discussion. If there’s one thing for people to understand at home about what’s going on in housing at the moment is that for 40 years, we have not been building enough homes. So we need to build more homes, and the kind of sleeper issue in all of this is about wages growth. We’ve been through nine years of a Coalition government that told us that low wages growth was a design feature of their economy. And we are trying to change that. So the things that need to happen here for us to address this situation in the long-run are about building more homes and making sure that Australian workers are properly paid, and that’s the policy objective of our Government.

Q: What is sustainable house price growth? What is the number?

O’Neil:

I’m not going to put a number on it, but it’s really important that we see wages going up faster, and us building more homes, and especially at that affordable end of the market where we’re going to see most home-buyers come in.

Q: Your mortgage plan, shadow Minister – I’m go on the Coalition figures I’ve read here. 110,000 households will benefit over four years, the average benefit $111,000. Your document says it will cost $1.25 billion. In one year, it would be $1.21 billion. Is the cost more, or is the $11,000 wrong? Or is it fewer households?

Sukkar:

No, we never said that the 11,000 is the average. The $11,000 is for the typical couple.

Q: Which one is it?

Sukkar:

Let me just answer the question. So for a typical couple who are on average full-time earning, this will save $55,000 over the five years. That is a significant benefit for first home-buyers. It’s going to be, Tom, with respect to costings. It will be a demand driven scheme. This won’t be capped. We’re not going to cap it. We will be delighted if as many Australian as possible are able to avail themselves of the first home-buyer mortgage deductibility

…Well, we’ll announce all of our costings at the right time, Tom. But I can assure you, we want as many young Australians to take up the first home-buyer mortgage deductibility measure, because it is not a capped scheme. And importantly, importantly, Tom, it’s a policy that adds to housing supply. Because one thing that I don’t think that many Australians are aware of is that in Australia, we don’t typically have new homes built unless someone is willing to pre-commitment to that home. Whether it is an first home-buyer willing to buy off the plan or whether it is someone wanting to put a deposit down on a house and land package.

Often it is a young first home-buyer having confidence and having the financibility to purchase. So the reason we want as many Australians as possible to take this up is – yes, we want them to become first home-buyers, but they’re also going to add to the housing stock of this country, and the HIA expects it to be 30,000 a year.

O’Neil:

This is what happens in public poll sip when you do sloppy work that isn’t properly looked at. This is dressed up as a housing policy. How can it be housing policy when it won’t build a single new home or get a single person who is renting today into homeownership who wouldn’t otherwise be there. What the Liberals have cooked up with a generational triple whammy for young people in the country. Peter Dutton not only wants you to pay off your landlord’s mortgage.

Michael Sukkar is still continuing with the furphy that the CFMEU is the reason house prices are going up and why house builds are delayed, when we know that the CFMEU are primarily involved in commercial projects.

And then to Michael Sukkar:

Q: You have criticised the Labor target. You don’t appear to have one. Will you set a target? And will you keep in place the housing planning reform the states signed up to, whether that be to reform it in some way, keep it, or will you scrap it?

Sukkar:

The problem for Clare and the government is that, when you continually say to Australians – who I think have every right to take you at face value – that you’re going to deliver 1.2 million homes when you’re falling hundreds of thousands of homes short, you’re insulting their intelligence. When you tell Australians as Clare just did then in her remarks that the Labor government’s building more homes – well, that is against every single ABS statistic that every single person in this room could find very easily on their phone.

We’re building fewer homes after three years of a Labor government than the former Coalition government which Clare criticises.

If the former coalition government was so terrible, I wonder how Clare will judge this government. Because they’re building 30,000 homes a year less. So we’re building fewer homes and yet we have a government putting out a target that they now know they won’t meet. They now know they won’t meet. We will build more homes than the Labor Party. In the preceding five years before this government came to power, Australia built more than a million homes.

Routinely, in Australia, over 5-year periods, in about the last 25 years, we’ve built more than a million homes. We’re not on track to build a million homes after five years of the Labor government, so we’ve actually gone backwards.

We’re not even maintaining the status quo of what Australia was building previously. So we’re going backwards and, at the same time that we’re going backwards, we have a government that’s had this genius idea to run a world-record migration program, which has driven rents up by nearly 20%. Renters are the biggest casualty of the Big Australia policy from the Labor Party, with 20% increases.

So I can assure you, Tom, and I can assure Australians – just like we built more homes in the previous coalition government, we will build more homes than Labor…

(But there is no target)

To the questions. First one is to Clare O’Neil:

You spoke about ambition and that $1.2 million target. Your own or the independent national housing supply council says you’ll be about 300,000 short. Are you willing to say you’re not on track and explain why?

O’Neil:

We need a bold and ambitious target because boldness and ambition is exactly what is required here. Instead of washing our hands of the problem, as the former government did, the PM’s actually stepped up and engaged with the states to negotiate a shared target across the country of 1.2 million homes. How are we going against that target?

I said we’ve built half a million homes since we’ve been in government. We’ve got critical policies in train that are helping us get there – things like fee-free TAFE, which Michael and his colleagues want to scrap.

Things like the planning reform that’s occurring at a state level. Do we need to do more? Absolutely, we do. If this was a simple problem that could be fixed in a 3-year term of a government, it wouldn’t be a 40-year-old crisis that’s been building for our country. What I do want to say to you, Tom, is that we’re making real progress against these targets.

Michael’s used some numbers there that are a bit old. It’s true that, some time ago, when we first set this target, the industry said, if you continue on this current trajectory, you are going to fall significantly short.

The last Master Builders report that came out showed that we’ve made up 240,000 of the gap… . ..just on the work that we’ve done. This is something the government is going to need to continue to work on. But we’re seeing really positive improvement in the data and we’ll continue to work with states and territories to get there.