Capital gains are larger than wages but barely taxed

Dave Richardson and Matt Grudnoff

Earlier this year the Australia Institute released a paper examining the worsening inequality of both income and wealth in Australia. It found that the share of Australia’s total wealth held by the richest 200 people nearly tripled during the last two decades – up from the equivalent of 8.4% of GDP to almost a quarter of GDP today.

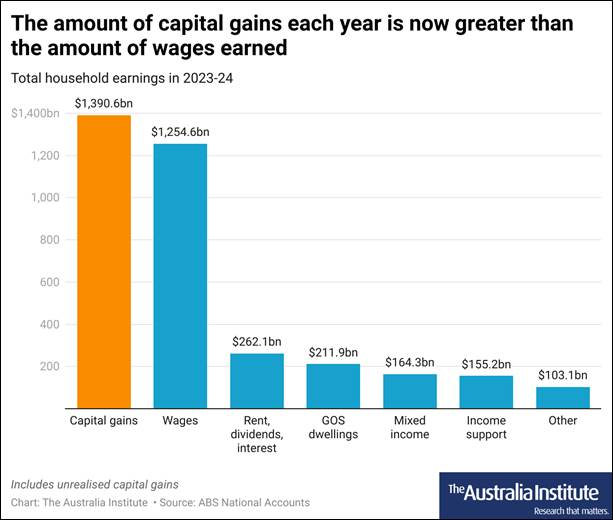

A recent report also showed that capital gains now are greater than wages.

Capital gains are essentially profits made from investments – generally either investing in shares or property. If you buy an investment property for $500,000 and sell it 3 years later for $750,000 you have made a capital gain of $250,000.

This marks a great change to incomes and is a major problem because largely capital gains go untaxed

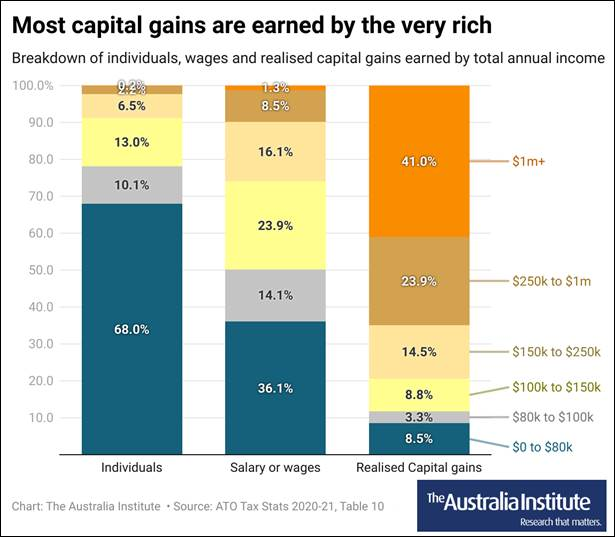

This also exacerbates inequality because overwhelmingly capital gain are earned by the richest in Australia.

That means we now have a situation where more income than wages is generated by capital gains most of which goes to the wealthy, but only a small fraction of capital gains are taxed and even then they enjoy huge tax concessions.

People with taxable incomes of more than $1m a year made up just 0.2% of all taxpayers in 2021-22, but they made up 41% of the realised capital gains.

Our tax system has not kept up with these changes and it means that inequality is being increased because of our tax system, not improved by it.

Currently capital gains get a 50% tax discount – that means that capital gains are taxed at half the rate of wage incomes.

This has neither ethically nor economically justified.

In 2019 the Labor Opposition’s election policies included a proposal to reduce the CGT discount from 50% to 25%, which would have resulted in 75% of the realized capital gain being taxed. That policy proposal lapsed when Labor failed to be elected, and has not been revisited since Labor came to government in 2022.

Reviving or extending to 100% of the realised capital gains, would reduce inequality and provide the government with necessary revenue to help address poverty.

Above all it would mean that those who gain income from investments that often only involve speculation would be taxed the same as those who get their income from work.